“Organic foods is in a secular upswing.” “Whole Foods’ new 365 markets are going to make a big impact with Gen-Xers and less affluent customers.” “The upscale shopping experience is worth the extra expense for Whole Foods’ core customers.”

Investors hear a lot of anecdotes like these in research reports, investment websites, and country club lounges. Unfortunately, for people without a solid investment process framework, these anecdotes come to take the place of analysis until the line between anecdotes and true analysis fades.

Last night, IOI Members and guests took a step away from misleading anecdotes toward a real understanding of the value of an investment in Whole Foods Markets (WFM). The group collaborated to analyze the four key valuation drivers and then derived a transparent, testable estimate of Whole Foods’ intrinsic value using the IOI Valuation Model.

The verdict?

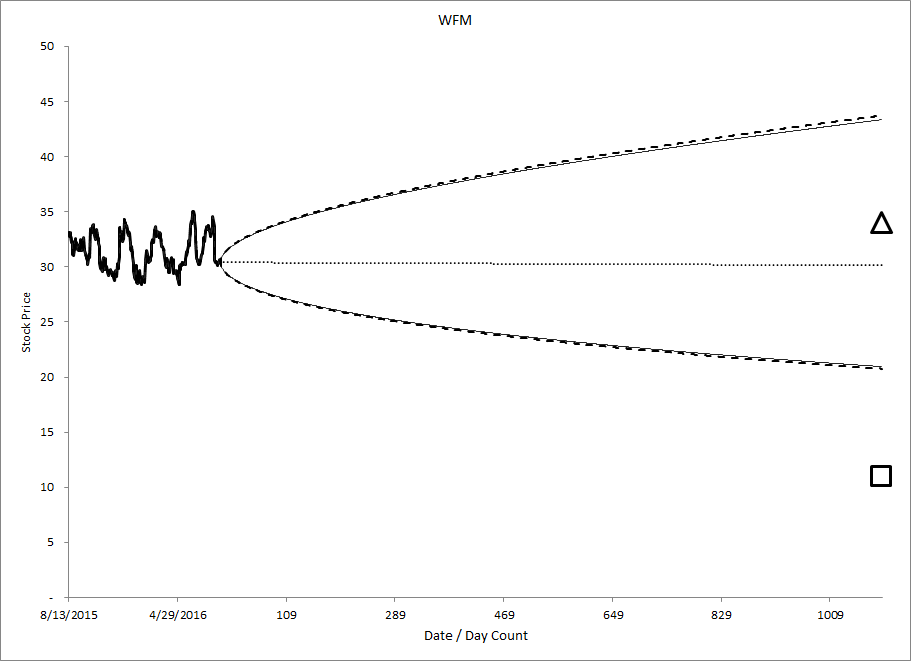

The group was even more negative on the prospects of Whole Foods than we were when we published a recent IOI Tear Sheet on the company to our members detailing a bearish investment strategy! The group’s consensus was that the present price of the stock represented the upper end of valuation range whose lower bound was barely still in the double-digit dollar per share region.

Figure 1. Source: Valuation produced by IOI Member group on August 11, 2016. Triangle represents Best-Case Valuation; Square represents Worst-Case Valuation. The cone-shaped region represents the option market’s best guess as to future price of the stock.

Our group analysis highlighted the importance of a rigorous, sensible process for assessing the value of a firm and showed how easy it was to pull together a full valuation by simply stepping back to take a clear-eyed look at how the business creates wealth for its owners.

Of the four key valuation drivers, we spent most of our time talking about the demand environment and best- and worst-case scenarios for revenue growth. Key takeaways from this analysis were that:

- It doesn’t matter how fast the industry is growing, it matters how willing people are to buy products from the company in question.

- New business lines (like Whole Foods’ “365” branded stores) can have a positive effect on growth, but this effect is usually small overall.

The revelation for the participants on the call was that these insights could be translated into numeric best- and worst-case scenarios and used to come to an understanding of the value of a company as a whole.

One of the IOI Members on the call, Jeff S., found this discussion of thinking through best- and worst-case scenarios particularly helpful.

“Great call. It was real helpful to go through that together and I learned a ton.”

Another IOI Member, Lee J., who graduated with an Ivy League MBA and worked in investment banking was similarly impressed.

“I actually learned a lot – and I think that was the most valuable hour or two in all the time I’ve spent with IOI – because we went through the process as we would by ourselves. There’s no substitute for that.”

This was the first time for us to structure the call as we did, and the feedback was so positive, we have decided to keep going with it while making some refinements. In the end, we’re convinced that our model of Read > Learn > Practice > Repeat is the key to gaining confidence and becoming a truly great investor.