I remember hearing my old portfolio manager talking with a fellow analyst about an investment the analyst had initiated. The stock had lost about 15% since the fund had began purchasing the shares. The portfolio manager’s laconic comment was…

“Well, I guess it’s fifteen percent better of an idea now.”

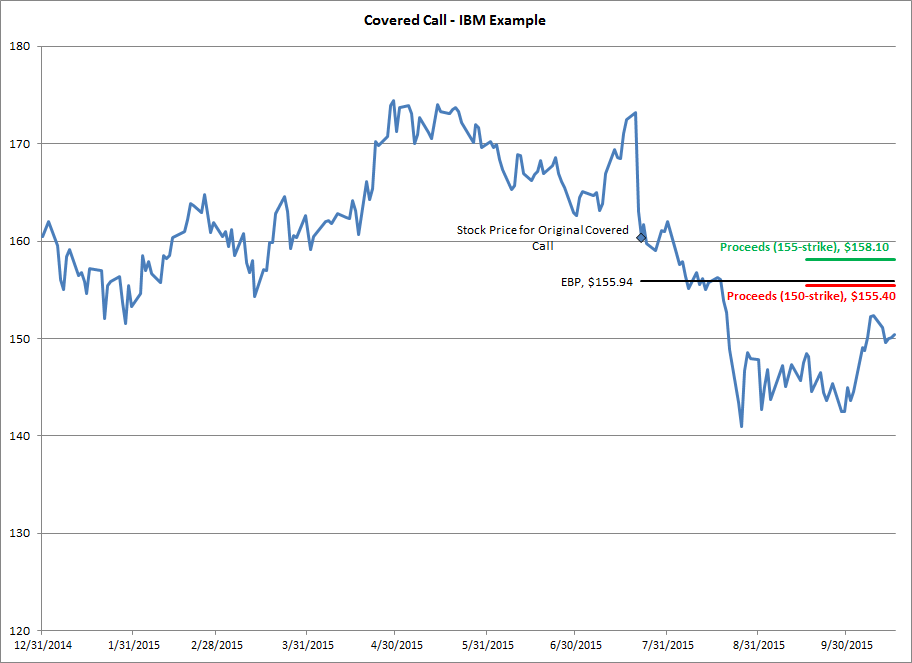

On 22 July, I published a Tear Sheet suggesting a “bond replacement” covered call strategy on IBM. The option I suggested was the 160-strike call option with an October expiration. The option just expired and since I made the recommendation, IBM has become an even better of an idea by about 6%.

This article discusses strategies for this investment going forward. It also explains the concept of “effective buy price” and sets down the first commandment of covered calls, so even if you have not invested in this name, make sure to read through!

The IBM Investment

IBM closed on Friday, October 16 at $150.39 per share. I initiated my transaction when the stock was trading about $10 higher than this and my effective buy price (EBP) net of transaction costs was $155.94 (I was upset about this execution, by the way, and posted an article warning others of using the pre-packaged “spreads” when executing strategies). EBP is simply the strike price of the strategy less the premium received; when I made my transaction, I promised to buy IBM at $160 and received $4.06 in return for making that promise, making my effective buy price $160.00 – $4.06 = $155.94.

Whenever one executes a covered call, there are two scenarios at expiration:

- The stock is trading at or above the EBP of the transaction.

- The stock is trading below the EBP of the transaction.

If you made this investment with an option struck at a price lower than $150.00 (one reader told me that he sold the IBM covered call when IBM was trading at $145), you no longer own IBM shares and have a realized profit equal to the amount of premium you received when selling the call. Congratulations! Your return on the investment is calculated by dividing the amount of premium you received by the strike price and is probably in the neighborhood of 4% over three months. Much better than you would receive on a corporate bond, to say nothing of a Treasury bond!

If you made this investment with an option struck at a price higher than $150.00 as I did, you are the proud owner of a fine Tech firm also owned by Warren Buffett and your EBP is calculated in the way I have done above. Congratulations! Your return on the investment cannot be calculated until you sell the stock, but my fair value estimate for IBM is the $200 region, implying an upside potential of (in my $156 EBP case) of just under 30%. IBM is paying around $1.30 in dividends per share each quarter (the next dividend will be paid in November), and that dividend serves to lower your EBP even more. The dividend yield at my EBP is 3.3% — just under the highest dividend yield paid by IBM over at least the last 10 years.

Managing Your Position

If the call option you sold expired out-of-the-money, you can of course sell a covered call on IBM again. On Friday, the at-the-money call option on IBM (strike price = $150) expiring on January 15, 2016 closed at a price of $5.40. If you invest in this strategy and the option expires OTM, your percentage return will be 3.6% over a period of 88 days (15.8% annualized).

If the call option you sold expired in-the-money (like mine), you have two possible choices:

- Continue to hold the stock

- Write another covered call on the shares

I generally prefer to hold the stock, and in this case, I’m very happy to own IBM at my EBP. If I were not comfortable about owning at that price, I would not have initiated the transaction in the first place. Remember, the first commandment of covered calls is:

Thou shalt not sell a covered call on a stock that you don’t mind owning at your EBP.

A covered call (and its close cousin, the short put) is essentially a commitment to own the stock if it is below the option’s strike price, so make sure you are comfortable with an investment in the stock at your EBP.

If you want to sell another covered call on your IBM holding, you’ll need to make sure to be careful with the strike at which you sell the call option. The flip side of the first commandment of covered calls is that by agreeing to hold the stock if it is below the option’s strike price at expiration, you are also saying you will sell the stock if its price is above the strike price.

If you agree to sell the stock for less than you paid for it, it’s obvious that you’ll lock in a loss, and locking in losses is not a good policy for investment success. For instance, in the case of IBM, selling the 150-strike call will generate $5.40 in premium and selling the 155-strike call, $3.10 in premium. Here is an illustration of these two scenarios:

If I sell the 150-strike call and the option expires OTM, I will receive proceeds of $155.40 and will have locked in a loss of $0.54. If I instead sell the call struck at $155 and the option expires OTM, I will receive proceeds of $158.10 and lock in a gain of $2.16.

Given only these two choices, obviously, selling the 155-strike call option would be better since, if successful, I would be able to realize a gain rather than a loss.

That said, even if successful, I will make only $2.16 on a principal amount of $155.94, or a return of 1.4% over a period of six months. While generating gains are better than generating losses any day, gains as paltry as this are hardly worth the accepting the risk of IBM as it is undergoing a major business transformation. It is for this reason that I generally prefer to own a stock if a covered call I have written expires in-the-money.

The Long View

IBM is a strong company and will be, I believe, a good investment in the long term. Shorter term, there is continuing uncertainty about its business transformation from services to software. IBM will issue a report of its quarterly results on Monday morning and it is expected to report its 14th consecutive quarter of revenue declines.

My model’s worst-case revenue scenario factors in an 11% drop for FY2015, a 2% drop in FY2016, and an average drop of 1% per year for the next five years. From what I know about the company, this is a reasonable worst-case assumption. Worst-case profitability and medium-term growth assumptions in my model are also fairly pessimistic, and even with these assumptions, my worst-case valuation range is at $164.

No matter what a valuation model says, stock prices will do what stock prices do. On a price-to-sales basis, I have figured that IBM may have on the order of $30 more downside risk from this $150 price level. If the price risk does materialize, I look forward to increasing my stake in IBM, likely on a levered basis.