Over the last couple weeks, we have written three investor education articles on the value of investing frameworks. The first explained why investing frameworks are invaluable tools for any investor. The second outlined three key characteristics of a solid, value-based framework. The third laid out the elements of our framework. This article shows how using a strong investing framework as your touchstone can help you in three common investing situations.

The three situations we’ll look at are:

- Case 1: An investment manager recommends that you shift of some investment assets away from a Technology ETF to one of an Industrials ETF.

- Case 2: Your friend gives you a hot stock tip about a single-drug biotech start-up as you’re driving in the golf cart back to the clubhouse.

- Case 3: You turn on the TV and an on-air investment celebrity is screaming “SELL EVERYTHING!” because of the latest macro crisis.

We believe that investing well means making good decisions, and making good decisions hinges on asking the right questions. It doesn’t matter if you work with an advisor or money manager or if you are managing your investments yourself or a mix of both. A sound, cash flow based framework keeps you from investing in anecdotes and pushes you naturally toward making investments in companies you get your head around.

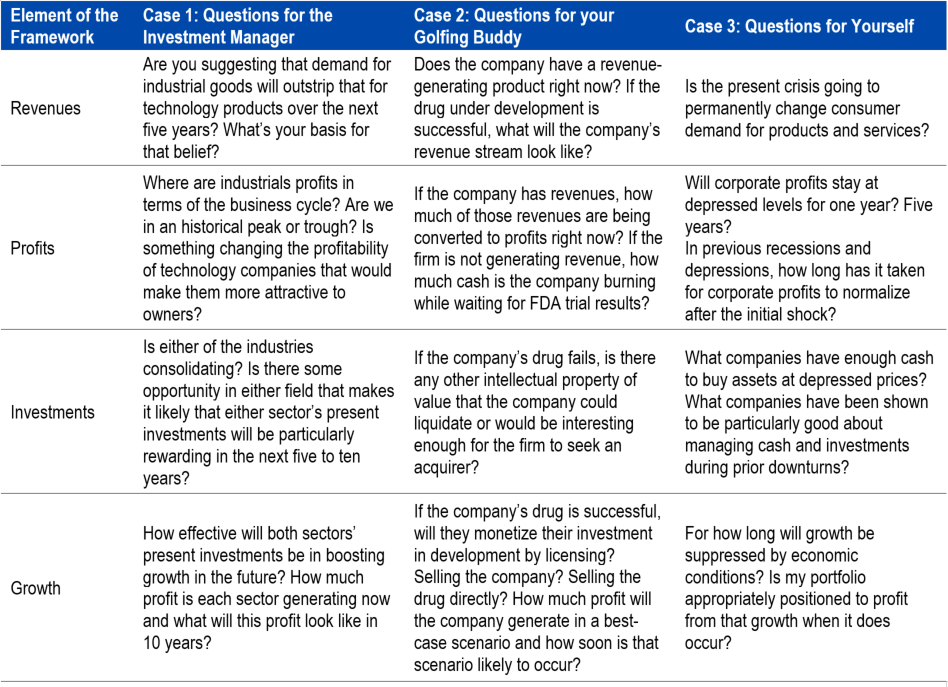

What are the right questions to ask? This is where having access to a solid, sensible investment framework serves you well. In the table below, we’ve offered examples of good questions you might ask, all of which reflect an intelligent investing framework which rests on a foundation of fundamental value.

In each of these cases, returning to one’s investing framework allows an investor to lean upon strong pillars of facts rather than upon flimsy piles of anecdotes.

The four-part investing framework above gives you a place to start analyzing the merits an investment idea or recommendation. One is no longer subject to just accepting a smooth-talker’s story or heading to the internet’s investing salad bar to pick at various pieces of potentially biased information.

As investors, our goal each time we commit our hard-earned capital to an investment should be understanding the idea and having a well-reasoned argument why this investment will generate a return that beats the market over our (long) investment time horizon.

The sample questions above show how to use a framework to get information you need to make intelligent decisions. Understanding how to use the answers you receive to estimate a valuation range is precisely the mission of our research reports and training courses.