When oil prices were hovering around 60 / bbl, I wasn’t as interested, but now that it’s fallen to half that or below, my ears are starting to perk up to oil-related news. In addition, several of my partners are starting to get interested in National Oilwell Varco (NOV) and while looking at that company’s results, I’m starting to read more stories about the supply / demand balance for oil.

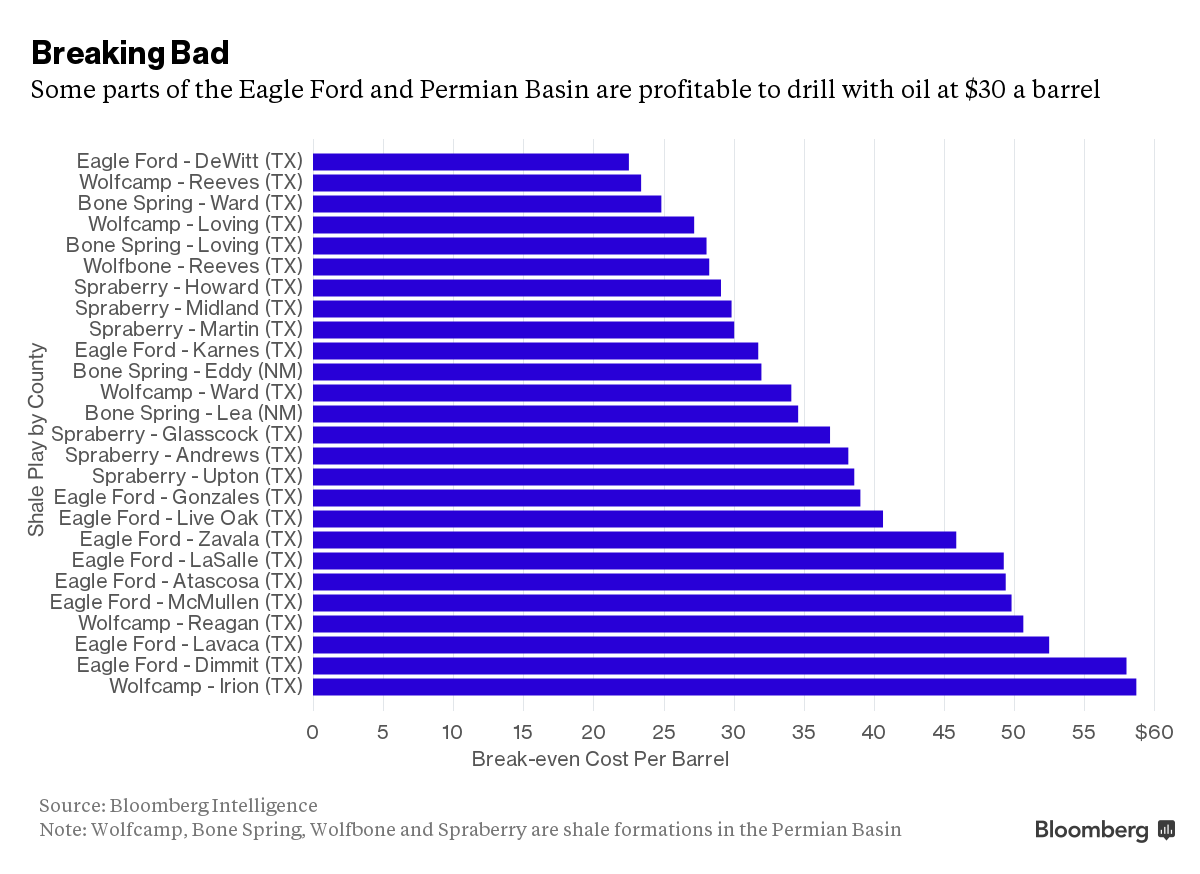

One piece that especially attracted my attention was an article in Bloomberg analyzing break-even prices for different oil producing regions. Some “plays” are easier to exploit than others so the costs to drill and extract oil differs from play to play. This graphic provides a visual overview of the spread between different shale oil plays in Texas:

As the price of oil has continued to fall, many observers have been expecting a large drop-off in U.S. production. The base assumption underlying this expectation is that the average price to produce a barrel of “tight” oil from a shale formation is in the $50 range.

It turns out that this underlying assumption simply is not true, according to Bloomberg Intelligence’s research.

A handful of shale patches in [Texas], which would be the world’s sixth-largest oil producer if it were a country, are profitable with crude below $30 a barrel, according to an analysis by Bloomberg Intelligence. In DeWitt County, which produced more than 100,000 barrels a day in November from the Eagle Ford formation, the average well can be profitable with U.S. benchmark crude at $22.52 a barrel, $4 below the lowest level this year.

If this is true — and the article shows good anecdotal evidence that it is — bearish expectations an Armageddon scenario in the high-yield debt market may well be overblown. This would be good news, not only to the luckiest pockets of the U.S. Energy sector, but also to banks and to high-yield bond investors.

The fact that there is so much uncertainty surrounding this issue simply highlights the great complexity underlying the economics of the oil business. I do not pretend to be an expert in the geology or mining technology, but am trying to approach a valuation of NOV using reasonable best- and worst-case valuation scenarios for revenues based on differing levels of oil drilling activity (NOV is an oil services firm, so the economics of its business are related only indirectly to the price of oil — if the price of oil is relatively high, eventually more drilling activity will start and that will help NOV).

One source that I have found helpful in at least understanding, at a high level, the mechanics of the energy business — from exploration and production to transmission to marketing — is a book called Oil 101 by Morgan Downey. Downey is a financial markets person who traded (and may still trade) energy markets professionally. Reading the book, I get the impression that it started as his notes about the oil business that he used as a personal reference when he was thinking about trading strategy. Unlike books that are written from the perspective of a geologist, Downey’s book gives a good overview of the economics of various aspects of the business, but is still technically detailed enough to rate 5-star ratings on Amazon from readers who are veteran petroleum engineers.

If you’re interested in the Energy business, read Oil 1o1. If you want to understand how to value a company that operates in the Energy sector, sign up for IOI 101!

To learn more about IOI Training, contact us!