We have been looking into PG as part of a valuation project for the Company which we will complete, along with an investment strategy (Tear Sheet) in the coming days. Procter and Gamble has had a period of well documented struggles coming out of the “Great Recession” period. Management missteps and sluggish global growth have conspired to challenge the Company’s financial performance, particularly relative to its peer group.

The result of this has been some major changes at the consumer goods producer, a strategic shedding of over 100 brands in concert with a $10Bn cost reduction program. Both efforts have come off well and most of the cost reduction program will be effected by the end of the 15/16 fiscal year (PG’s operating year starts in July and ends June). The sale of much of PG’s beauty business to Coty will be completed in the new 16/17 fiscal year and likely drive as much as $15Bn to PG’s coffers depending on the stock price of Coty at the closing date for the transaction. Combined with the ~$4.5Bn received from Berkshire Hathaway for the Duracell business, PG will do almost 20Bn in asset sales just in the last 12 months. The total brand sale haul will be between $23 and $25Bn.

In the meantime, PG has been focused on driving operating efficiency and cleaning up management. Here are a few highlights.

- Leadership: AG Lafley turned over the CEO position to David Taylor and a number of upper level managers exited with divested businesses or retired. Mr. Taylor continues to revamp his leadership team, including external hiring, while focusing the new P&G on 10 core categories.

- Culture: Culturally, the Company was operating as if it were outperforming financially with accountability spread across too many internal functions and no one owning business results exclusively. Mr. Lafley addressed this in 2015 restoring General Manager decision power and refocusing the Sales organization. Mr. Taylor is expected to continue driving accountability for sales and profit goals down the brand leadership organization.

- Operations/Strategy: While the Company sold off more than 100 brands, it did so while retaining 95% of it’s profits. This shows the operating strains of a local brand acquisition model that P&G employed to establish its global footprint as well as a battle with the fickle cosmetics and fragrances market where they ultimately had to admit defeat.

What is left is a leaner, more focused Company that can apply its significant resources to its best businesses. As a shareholder, that’s exactly what we want. There has been a non-trivial amount of banter that PG should consider breaking itself up. What is missed in those analyses is the value of all those different products at the retailer. PG obtains significant leverage with retailers because of its brand portfolio strength. Breaking up the business would effectively eliminate this material competitive advantage. What PG has done is the smart thing – sell the brands that do not contribute to its financial, retailer or consumer strengths. Now it can focus itself on more efficiently applying growth investments to those remaining core businesses/brands.

What makes PG tick as a money making engine? Well, the IOI process is to look at three value drivers: revenue growth, profitability (through the lens of Owners Cash Profits) and investment efficacy (how good has the company been at taking profits and investing them for growth vs. GDP).

Looking at revenue growth, it has been anemic at best. Some of this is due to market factors, for example the effects of dollar strength on PG results have been in the negative double digits this last year. In that sense, PG is uniquely exposed. Unilver (UL ) for example is domiciled in Europe where the Euro has weakened. The rest of the US consumer product companies do not share PG’s global revenue exposure (now over 60%). Even adjusting for currency effects, however, PG has struggled to grow it’s top line.

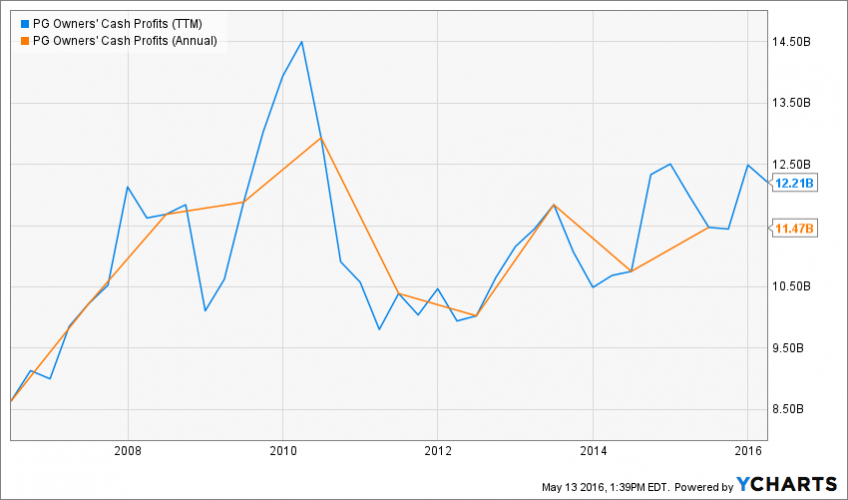

In the win column, the Company’s profitability has improved markedly in the last 2 years through a combination of cost savings and managing for better cash productivity (% of earnings converted to cash). The chart below shows Owners Cash Profit (IOI’s preferred method of looking at profitability) margins progressing from the low double digits up 300 basis points and recent quarterly results show this metric in the high teens. OCP for the 2015/16 fiscal year are on track for ~$12Bn, a five year high, on a much smaller brand footprint.

And these profits, combined with share effects from divestitures, have resulted in the return of over $15BN to shareholders in 2015/16. Between now and the end of the 2019 fiscal year the Company expects to be able to return $70Bn to shareholders through a combination of dividends and share consolidation. That’s a massive number for any company, and the commitment should keep PG disciplined on acquisitions.

The jury remains out on PGs ability to grow the topline, but the Company has set up a much stronger base from which to drive growth. Emerging and white space markets are a key concern, as the Company’s developed market businesses will grow only slowly. PG is showing signs that they understand this core driver and are making progress in key markets. The following examples come from CFO Jon Moller on PG’s recent earnings call.

“In Mexico, we made the choice to discontinue low-tier, unprofitable, and commoditizing toilet paper products in favor of profitable high-tier differentiated products. Sales are down 75%, but before-tax margins have improved by more than 50 basis points, from very negative to nicely positive. It will take a few more quarters for the top line drag to dissipate, but there will be a solidly value-accretive business going forward.

We’re making progress in China, but there’s still more work to do. We narrowed sales declines by half this quarter and expect to improve again next quarter. We recently upgraded our Pampers premium diaper pants to improve fit and softness, and we have new innovations coming soon on mid-tier pants and premium taped diapers. Oral-B Super Premium toothpaste launched in over 700 stores last quarter, reaching roughly a 5% share in those outlets. We’ll triple distribution on this item this quarter. Ariel is growing in China following the concentrated liquid detergent launch in January. Gillette Fusion FlexBall has driven male razor system share growth over the past three, six, and 12-month periods. And SK-II continues to deliver very strong growth, with sales for the quarter up nearly 20%.

In India, we’ve made a choice to deprioritize several unprofitable lines of business which negatively impact short-term top line growth rates, but will lead longer term to a much more profitable business that will grow strongly. The strategic portion of our India business is growing at a high single-digit pace. Sales in the portion we’re fixing or exiting have been down more than 30%. This top line pain is worth it. We’re making significant progress in improving local profit margins, up about 700 basis points. We’ve gone from losing significant money in India to triple-digit profits in just two years.”

Focusing on profitable growth while adjusting for consumer value is the strategic and tactical balance that will get PG back to effective top line growth. The examples above exemplify the strategy of a premium consumer products producer. PG cannot be all things to all people. It will succeed by delivering the best products for the best value; products that deliver consumer-recognizable benefits, and then doing a best in class job at communicating those benefits in a way that’s relevant to consumers.

At IOI we are building out our revenue scenarios accounting for these potential eventualities. This will result in our IOI valuation range for PG. From there, we will be able to effect a clear investment strategy by taking into account that range of values and overlaying it with market expectations communicated through option pricing.

To learn the stepwise process we apply to achieve these disciplined investing strategies, check out our IOI 100 Level Investor Education Series or join IOI on a paid monthly membership! You can be a better investor and IOI is your best choice for education, mentoring and guidance.