In early November, 2014, I published an IOI Tear Sheet featuring a short put investment in Oracle (ORCL) struck at $39 per share and expiring in March 2015.

That investment expires today?and barring a truly catastrophic fall in Oracle’s price over the next six hours, will expire OTM. Selling puts (or selling covered calls–an equivalent strategy in terms of risk / reward), while a pretty straightforward strategy, presents some difficulties in terms of portfolio management. I review the transaction and discuss some of those difficulties in this article.

My investment in Oracle?began in the summer of 2013 and I have used various structures to invest in it over this period. Initially, I sold short-tenor puts after an earnings report that the market took badly, then, after doing more research on the firm, sold more short-tenor puts to subsidize long-tenor OTM call options and a few days later, followed up that investment with an investment in the underlying stock and in lower leverage, long-tenor ITM call options.

As the stock price moved up, the short-tenor options started to expire OTM, and I started realizing profits from?the higher leverage parts of the investment to leave myself with a more lightly-levered investment in the firm. By November of last year, I was only holding the underlying shares when an ill market wind blew the stock down to the $39 per share level. Option prices increased at this time, so I decided to sell short tenor puts on the stock again, generating roughly $200 per contract in income (see the Tear Sheet linked above for the specifics). I fully collateralized the short puts, creating?an unlevered structure.

I sold three put contracts for every 200 shares owned, so had those contracts expired ITM, I would have more than doubled the size of my exposure in Oracle. Were this to have happened, my position in the underlying stock would?have?represented over 20% of my portfolio value. I would have treated the premium income received as a rebate to my purchase price, and would have had an overall Effective Buy Price (EBP) of roughly?$34 per share on my entire position?if the options expired ITM (an EBP of $37 per share on the new holding and one of roughly $30 on the old).

If the contracts expire OTM?(as they look like they will), I will simply consider the premium received as a rebate on my original purchase of the shares; this means that my new EBP for this position will move?down to $27 per share. If and when I initiate another investment in Oracle, I will use this EBP to calculate potential risk / return scenarios when I am structuring my investment.

The difficult thing about this strategy of selling put contracts on a stock you already own is managing your portfolio’s allocation. In effect, you have to plan for two eventualities–that the puts expire worthless or that you will end up changing the allocation of your portfolio, perhaps significantly so–and be happy with either of those eventualities.

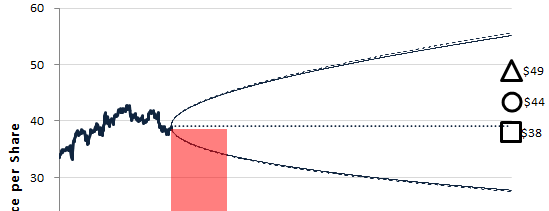

In the case of Oracle, a return of ($2 / $37 =) 5.4% over a period of roughly four months seemed like a nice income boost (in the case the stock expired OTM) and an EBP of $34 per share implied about a 30% return to my fair value estimate of $44 / share, which seemed like a reasonable potential return as well, and one that I would not mind allocating a substantial chunk of capital towards.

At the same time, I saw the potential for a much larger return in General Electric, so preferred to allocate more capital at a higher leverage level to that investment than to the one in Oracle. I certainly could have created a levered short put structure for the Oracle investment (by selling put spreads rather than puts) and tied up less capital in collateral. However, maintaining?a levered investment structure in GE and another levered investment structure in Oracle would have left me, I thought, with too high of an overall leverage profile, especially in light of the rather modest returns I expected from Oracle.

While it has turned out that Oracle’s price has moved up to the $44 level and that I would have made more money by buying the stock at $39 than selling puts on it, the risk / reward profile would have not been nearly as attractive to me in this case. At the higher level, my expected return to my fair value estimate was a mere 13%. Selling puts has earned me a bit of extra money, reducing my EBP for the position, and allowed me to tilt the balance of risk and reward a bit more in my favor. I’ll call that a win.