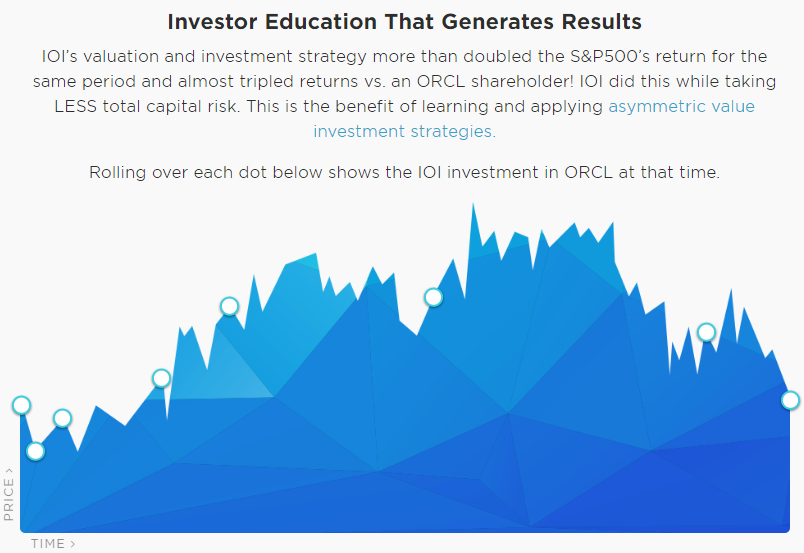

One of the great advantages that options confer upon an investor is the ability to tailor risk and return exposures. The IOI homepage has an example of the way this exposure tailoring works in the real world for an actual position in Oracle.

The essence of intelligent option investing is to first find a business that is trading for less than it is worth, then to adjust exposure to that business depending on how large the price-value discrepancy. My base position is usually unlevered. I am either writing a put (i.e., promising to buy a stock at a certain price in exchange for receiving a monetary premium) or buying shares of the stock.

As my knowledge about the company increases and I become more confident that the understanding underlying my valuation is correct, I begin to layer on prudent levels of leverage.

(There was a wonderful paper published a few years ago entitled Buffett’s Alpha, which attributed Buffett’s investment success partially to the prudent use of leverage. Buffett gains leverage through the ownership of insurance companies, whereas I am using the listed option market to do the same thing.)

As the market price of the stock moves closer to my valuation range, I “peel off” some of this leverage, reducing my market risk but still leaving me with a base position in the stock.

If the stock moves to the upper end of what I consider to be a fair valuation range, I will reduce my exposure even more by taking profits on the stock. Conversely, when the market hits an air pocket and drags my investment down with it, I’m free to increase my leverage again.*

In the case of my long-standing position in Oracle, I had increased the leverage on my position in the company in January of this year when the stock fell into the mid-$30 range, and it is now my most concentrated and levered position.

On June 1, a former employee of Oracle filed suit against the company, alleging that she had been improperly fired for refusing to overstate Cloud revenue numbers on orders from her superiors (here is a copy of the complaint). The stock fell several percent on the news and has fallen a bit more since, perhaps also affected by free-floating angst related to Brexit and employment figures.

My first thought upon hearing the lawsuit news was to reduce the leverage on my position, but in the end, I have left the leverage levels unchanged. I have no idea if this was the right decision and am torn between two considerations.

On one hand, any shenanigans involving revenues are one of the most serious and brazen sorts of fraud a company can perpetrate, so any whiff of doubt about sales is worth taking seriously. On the other hand, the only information I have about this alleged wrong-doing is what has been reported in the news. Also, at various times during my professional career, I have witnessed employees filing suits with no basis in fact in the attempt to win a money settlement. For all I can tell right now, this instance may be a case like that.

Oracle faced accusations of accounting improprieties in the early 1990s and the company settled with the SEC in 1993 without admitting wrongdoing. I had always considered that chapter in the company’s history the act of immature business people acting too big for their britches at a hot start-up. The current news, however, has uncomfortably reminded me of that incident, and I may decide to do something I rarely do – close a long-standing position outright.

Oracle reports quarterly earnings tomorrow, and of course earnings reports are another source of short-term uncertainty and volatility. I’ll be listening for comments regarding the suit and will continue assessing my position in the stock.

Notes:

* This method mirrors that of a portfolio manager for whom I once worked. He knew a dozen or so stocks really well and would invest in them – either on the long side or the short side – whenever their price deviated from what he knew to be a reasonable value.