This blog posting is the second in a series. Please also see the previous post, which discussed the effect of lower oil prices on GE?s Oil & Gas segment.

In GE?s 3Q14 conference call, oil was a big topic of discussion. Immelt spoke about it extensively. Analysts spent a good bit of time probing GE?s chief about the firm?s oil price projections and likely impact on the top and bottom lines.

But there was one question that remained unasked. No one mentioned the effect of plunging oil prices on GE?s finance arm?GE Capital Corporation (GECC).

Since oil fell below about $75 / barrel (bbl), industry analysts have started to question the sustainability of many small oil and gas exploration and production (E&P) companies? businesses. These businesses have taken on huge amounts of debt in order to fund one after another fracking wells.

?Tight? oil and gas formations?the kind that are mined by fracking?tend to have a large initial production that quickly falls off. Some wells are more productive than others, and a company may have to drill a few times to find a well that is a good producer?kind of like a game of Russian Roulette in reverse.

A good well will pay for a few duds?making the average cost of production relatively high for fracking, even though the costs for a single productive well may be low. Too many duds between each good well will create cash flow problems for the E&P if it cannot get the necessary financing to keep going.

For better or worse, the capital markets have stepped into the funding role in a big way, to the tune of a quarter trillion dollars in debt and a good bit of equity to boot.

GECC, one of the largest corporate lenders in the U.S., has exposure to the energy funding boom primarily through two businesses. One, called Energy Financial Services (EFS), provides project finance for companies in the energy business. [1]

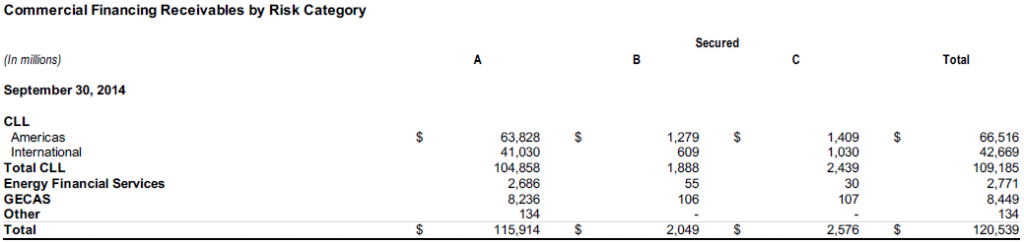

EFS has roughly $2.7 billion in receivables out of a total of $120.5 billion (2.2%) and 97% of these receivables are classified by the company in its lowest risk bucket.

Figure 1. Source: GE 3Q14 10-Q

While I tend to take with a grain of salt GE?s classification of these assets into one risk bucket or another, the fact that EFS?s total assets are a small percentage of total suggests an extended oil price decline will not have a material effect on this business at least.

The other business with exposure to energy funding is Corporate Lending & Leasing, or ?CLL? in Figure 1 above. CLL?s main business is leasing out equipment to companies?especially focusing on mid-sized enterprises. It would be nice if GE supplied investors with information about sector exposure of its CLL portfolios, but alas, looking at the supplemental materials for GECC as of 3Q14, that level of detail is not available.

Looking back at Figure 1, however, we see that there are a total of around $66.5 billion in receivables in the Americas. Because shale oil fracking is mainly a North American sport, we can focus in on that amount. Not all of these loans will have exposure to the energy business?a good bit of it is the rental of rolling stock and other railroad equipment?but even if we assume that energy-related lending is 20% of that amount, it still is a fairly modest exposure of $13.3 billion, or 11% of total receivables outstanding.

These estimates give an idea of the approximate magnitude of GECC?s exposure to energy lending, but without more detailed company statements, it is difficult to tell how sensitive GECC?s cash flow?which makes up the lion?s share of GE?s consolidated operating cash flows?will be to reduced oil prices.

Loan origination will certainly fall due to lowered demand for financing from E&P companies, but in fact, receivables have been falling over the last year in both the CLL Americas line and the EFS line. This suggests that demand was already beginning to drop or that GECC was becoming more cautious in its lending.

Revenues (which come from ongoing repayments as discussed in this article) will also likely fall as borrowers and lessors become harder pressed to repay loans or equipment rental payments. This will also cause lower profits on an accounting basis and also lower cash flows, but by how much it is hard to tell.

Another point that bears mentioning is that, even though the above approximation applies to the extent to which low oil prices will directly affect GECC?s energy lending, GECC likely has other indirect exposure to the sector as well. For instance, GECAS is GECC?s airplane leasing branch; GECAS recently acquired a company that leases helicopters. This company?s sales are concentrated in the energy sector, so they may also be affected by an extended period of low oil prices.

As unsatisfying as the uncertainty is, at the present time, it is hard to assess how great of an effect low oil prices will have on GECC. My worry is that effects on GECC may actually be more extreme than on GE?s Oil & Gas Segment, and this concern is exacerbated by a lack of transparency into GECC?s loan portfolio exposure.

NOTES

[1] Project finance simply means making collateralized loans or arranging debt or equity financing to companies in order to complete a specific project. For instance, let?s say a company wants to build a pipeline. The company might get project financing for the capital outlay necessary to build the pipeline, and use proceeds from the pipeline to pay back the money.