After market close today, we published a new IOI Tear Sheet ![]() covering consumer products giant Procter & Gamble (PG). While we do not see the opportunity for an investment that tilts the balance of risk and reward in our favor, valuing P&G provides an interesting case study into investment efficacy and growth.

covering consumer products giant Procter & Gamble (PG). While we do not see the opportunity for an investment that tilts the balance of risk and reward in our favor, valuing P&G provides an interesting case study into investment efficacy and growth.

PG has been involved in a period of transition that makes assessing its respective growth rates challenging. From the mid-1990s to the mid-aughts, the firm was spending an enormous amount on acquisitions. This acquisition frenzy ended in 2006 with the purchase of Gillette for roughly $55 billion.

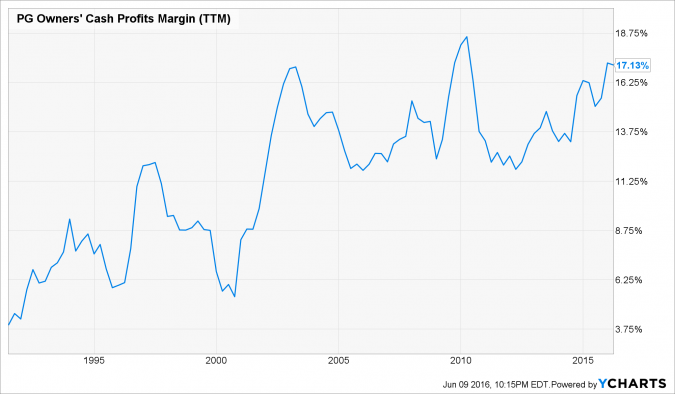

Over the past several years, the firm has been moving in the opposite direction – shedding less profitable and non-strategic businesses. These divestitures have slowed revenue growth but increased profit margins – which are now near their historical high-water mark.

During the acquisition-heavy period, PG spent roughly half of its profits on investments and grew profits at 10% per year. Post-Gillette, PG spent around 20% of profits on investments and profits have grown 3% per year.

Future growth in revenues and profits will depend on PG buying or building successful businesses in scalable markets like China and India, efficiently entering under-exploited product categories in S. America, and doing a better job of serving older American and European consumers.