Oracle reported third quarter results for fiscal year 2017 on March 16th and the share price jumped over 6% the day after the announcement was made.

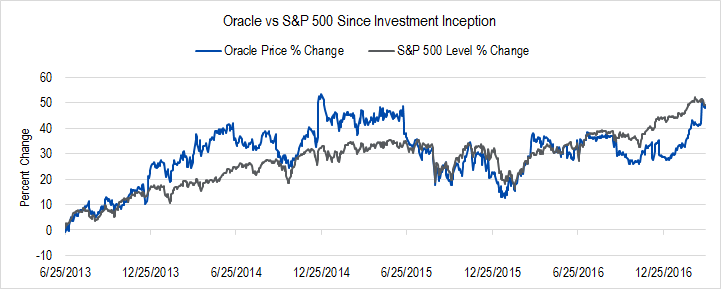

Since we first recommended an investment structure in Oracle, the firm’s stock has just kept up with the S&P 500 index, but the option structures we have used to invest in the company have allowed us to wring more than double Oracle’s stock returns over this time. This kind of return enhancement is precisely what we mean when we talk about “tilting the balance of risk and reward in your favor.”

Figure 1. Source: YCharts

We have analyzed the third-quarter earnings release with an eye to whether or not there was information material to our estimation of the company’s valuation range.

Here is what we found.

Executive Summary

- The news is mixed, and the valuation uncertainty of this firm has increased.

- Positive points:

- Cloud revenue increases very strong

- Overall revenue increase was just at the midpoint of our long-term best- and worst-case forecasts

- The vitally important “Software Updates” business’s revenues are steady

- Negative points:

- Profitability has slipped and may continue to weaken as the company focuses more on Infrastructure-as-a-Service (IaaS)

- Investment spending that decreases Free Cash Flow to Owners is likely to increase

- Neutral point:

- Hardware revenues continue to fall

- We have decided to hold off on revaluation until we get more information that will allow us to better assess Oracle’s IaaS initiative.

To read the detailed article, please consider taking a trial IOI membership. The first month is complementary, and you will have unrestricted access to our members-only calls and to our training materials and reports during this time.