[This article originally appeared on Forbes]

Normally, when you see an analyst lowering his or her “target price” or “fair value estimate,” it’s a sign of the analyst’s decreased confidence in an investment. However, for an intelligent investor using a disciplined, scientific valuation framework like the one we teach in our training classes, it can be a sign of increased confidence in an investment.

This is certainly the case in our recent re-valuation of IBM! An analysis of IBM’s most recent annual statement has allowed us to significantly narrow our fair value estimation range for the company and suggests to us that IBM’s operational performance in three areas key to its valuation — revenue generation, profitability, and medium-term growth — will be at the top end of our present range (or above). Our analysis has led to our publishing a new IOI Tear Sheet detailing an option strategy we term a “bond replacement” investment.

Option Investment Strategy

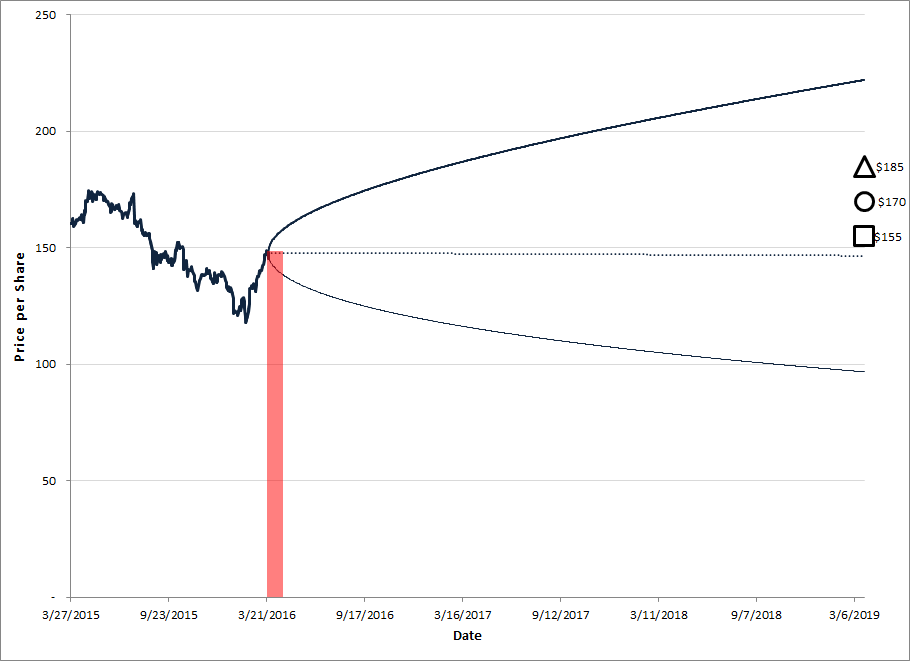

When we published this Tear Sheet, IBM’s “bond” (constructed by selling a cash-secured put) would yield the equivalent of over 40% per year. Not bad for a stodgy old Blue Chip stock. The graphical representation of this IBM bond replacement strategy looks like this:

Figure 1. Source: CBOE, YCharts (data), IOI Analysis

It’s important to realize that, while we call this short put investment a “bond replacement” strategy, there important differences. Short puts are equivalent from a risk perspective to covered calls, and a lot of people completely misunderstand how to properly implement covered calls. For more information,here’s a brief article discussing the points that people most often trip up on. (Again, to understand options and covered calls even better, the best thing to do is join our next IOI 100-Series training course in San Francisco, California!)

Now that we understand the end game, let’s look at the reasoning behind the valuation that led us to this strategy. We’ll focus on the key three drivers of value: revenues, profitability, and medium-term cash flow growth.

Revenues

Of the three factors that affect valuation, this driver has the most influence on our reduced fair value estimate for IBM. Even analyzing IBM’s financial statements, listening to the earnings conference calls, and combing through industry news, we still have a hard time getting a handle on what IBM’s near-term best- and worst-case revenue scenarios might be. Three issues complicate the matter:

- IBM’s business is changing. It is selling off non-core software product lines and completely restructuring its service offering. It’s tough for anyone outside the company (or even inside the company, most likely) to know what the extent and timing of these actions will be.

- IBM’s nominal revenues are affected by foreign exchange fluctuations. This is a bookkeeping issue, rather than an economic one as I explain in this article (the article discusses General Electric, but the points regarding foreign exchange are applicable to IBM as well), but it does make forecasting tricky.

- IBM is shifting some software products to the Cloud. Cloud revenues cannot be “recognized” all at once, but instead are “ratable” as I explain in this article (relates to Oracle, but applies to IBM’s Cloud revenues as well). Due to an accounting rule, this switch ends up depressing nominal revenues and boosting IOI’s favored profit metric, Owners’ Cash Profits (OCP) (which is similar to Buffett’s “Shareholder Earnings”).

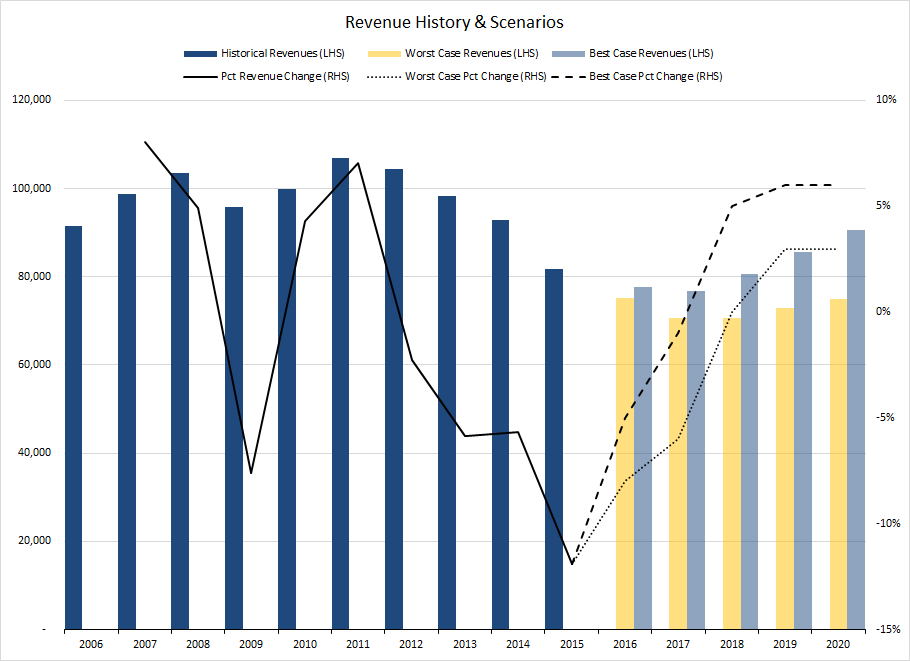

Because we do not have any better than anecdotal evidence for what IBM’s revenues will be in the near-term, we have plugged in the high and low revenue estimates of Wall Street analysts for our valuation model’s Year 1 revenue projections. (Using Wall Street research as a sort of educated coin flip is one of the only valid uses for this research we’ve found over 20 years in the business.) Incorporating this assumption into our valuation model, we wind up with best- and worst-case revenue assumptions over the next five years that look like this:

Figure 2. Source: Company Statements, IOI Analysis

These assumptions are considerably below our original revenue growth assumptions. You can read more about the comparison of our original projections and our updated ones in this article.

Profits

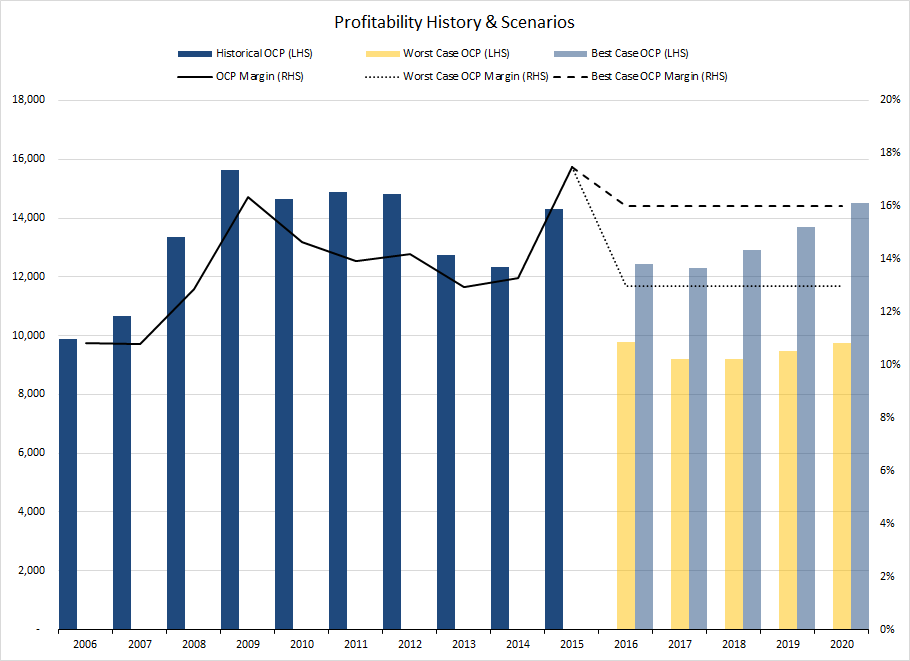

After having written a detailed article in January entitled Profits are Booming at IBM, we will not belabor the point here. Reviewing IBM’s annual financial statements, IBM’s profits as measured by OCP were even higher than we had expected in January and in another article, we characterized IBM’s profitability “astounding.” Still, we suspect that the elevated profitability level is at least in part due to the issue of ratable revenues mentioned above, so we have kept our best- and worst-case OCP margin assumptions unchanged from my original model. The graphic illustration of these assumptions look like this:

Figure 3. Source: Company Statements, IOI Analysis

Medium-Term Growth

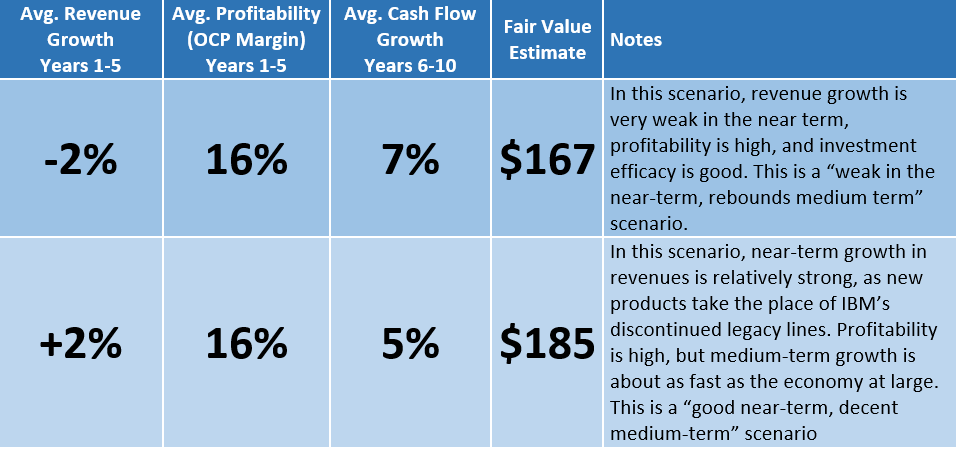

“Medium-term” means years 6-10 of our valuation model. This is the time frame in which the effects of IBM’s present-day business strategy realignment and investments in Cloud software will become apparent to investors. Considering the brisk growth of revenues in IBM’s “Strategic Imperatives” businesses (which include Cloud computing and artificial intelligence — Watson), we have projected best-case growth of the metric IOI uses to value companies — Free Cash Flow to Owners (FCFO) — of 7% per year. In the worst-case, we have projected medium-term growth of FCFO to be 5% per year. There is solid academic research and a sensible reason for projecting these levels of 5% and 7%, but not enough room here to fully discuss. (To understand our reasoning behind this and to learn more about IOI’s disciplined, step-wise valuation method, the best thing to do is join our next IOI 100-Series training course in San Francisco, California!)

Most-Likely Scenarios

Incorporating these operating assumptions into our valuation model and selecting the scenarios we think most likely yields the following valuations:

The take-away from all of this is while we are uncertain exactly how high the value of IBM is, we do have a high level of confidence that the market is paying too much for downside protection of IBM. We are happy to act as an insurance company by selling nervous investors some overpriced put options.

To Learn More, Contact Us!