Over the weekend, General?Electric announced that?it had sold its consumer finance operations in Australia and New Zealand for?$6.3 billion to a consortium of private equity investors; analysts questioned?by Bloomberg were?generally positive about the transaction.

This news will come as?no shock to intelligent option investors, who have followed my coverage of GE?for the past few months and know that GE is repositioning itself away from?consumer facing businesses, especially finance-related ones.

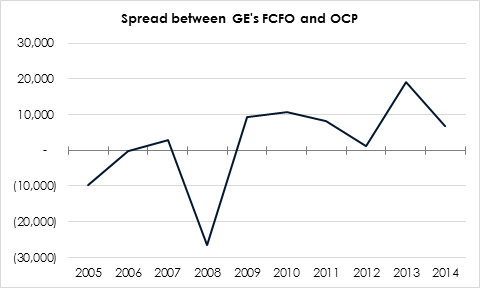

In essence, GE is selling?off profit-generating assets to ?buy? free cash flow. You can observe this?trend by noting that for eight out of the past 10 years, the level of GE?s Free?Cash Flow to Owners (FCFO) has been at or higher than the level of its Owners??Cash Profits (OCP). [1]

FCFO is usually lower?than OCP by the amount of cash flow a company is spending on growth?investments, so GE?s FCFO coming in higher than OCP means that it has generated?cash through disinvestment rather than spent cash through investment.

While a management?selling off its source of future potential growth is not usually great news, in?the case of GE, it looks like a good idea. GE is redeploying the capital it?receives from asset sales to boost its infrastructure-related products and?services business, especially the overseas arm of this business.

Your mind might?immediately jump to GE?s recent purchase of most of the assets of French power?generation equipment maker, Alstom, but on the same weekend the sale of the ANZ?consumer finance business was made, GE also announced investments in Egypt, Saudi Arabia,?and Ghana.

Positioning GE as an?infrastructure firm makes a great deal of sense, as I point out in the IOI Institutional Report on GE,?and the focus on overseas operations also makes good sense from a valuation?maximization point of view.

First, as long as GE?does not repatriate profits generated by overseas subsidiaries, it is not?required, under present U.S. tax law to pay taxes on those profits. As?discussed in the IOI Institutional Report, this tax savings represents a?material boost to the firm?s valuation.

Also, keeping its offshore?profits offshore allow for it to generate a natural currency hedge and shield its?shareholders from the effect of foreign currency fluctuations. Forex gains and?losses are represented as a deduction of shareholders? equity, and, indeed, if?cash was repatriated from a country whose currency?s value was falling against?the U.S. Dollar, the deduction from SE would accurately represent the reduced?purchasing power of U.S. owners. However, since GE is keeping its profits?overseas and re-investing in its business there, currency translations do not?represent a loss of shareholder purchasing power.

Over the past few?weeks, market rumors have circulated that GE might not stop at paring only its?consumer-facing finance business, but also divest itself of some of its ?middle-market??finance business. The middle-market finance business is one that loans money to?small and medium-sized enterprises, in transactions like the one announced in this recent press release.

If this in fact does?play out, the time that it takes for the market to price in what I believe is?an important inversion point for GE will likely take a bit more time.?Divestments make historical comparisons difficult and also make it hard for the?market to perceive growth in revenues and profits. The end result of this is?that the portion of the IOI investment structured as In-the-Money call options?which expire in just under a year may have to be ?rolled? to a later expiration.

NOTES:

[1] You can find definitions for IOI’s preferred profitability and cash flow metrics on the following pages: Owners’ Cash Profits, Expansionary Cash Flow, Free Cash Flow to Owners.