My week was bookended by corporate news – General Electric on Monday and Amazon-Whole Foods- Kroger on Friday – holding up a set of increasingly worrisome, crazy political news – a sitting president under criminal investigation, political violence leading to severe injury and death, and a college student in a permanent vegetative state after a sophomoric prank. The world these days is nothing if not interesting.

Here is a curated list of important stories outside the main headlines that caught our attention this week.

GE’s Immelt: ‘Every job looks easy when you’re not the one doing it’ (Financial Times). Because of my long coverage of General Electric, every article about GE caught my eye this week. I liked this one mainly for the title, but it does talk about GE’s CEO transition process and growth in the Chinese business, along with some interesting anecdotes. Here are some other good articles about GE this week:

- G.E.’s History of Innovation (NY Times). A nice 100-year retrospective

- Authers’ Note: Neutron Jack (FT). A look back at Welch’s tenure

- For G.E.’s John Flannery, It Was a 30-Year Trip to the Top (NY Times). A look at the new CEO

- GE’s Immelt Steps Down, Flannery Moves Up Amid Trian Squeeze (Bloomberg). Discusses the transition in terms of pressure from Nelson Peltz’s Trian Fund – a large holder of GE stock

- Was Immelt a Better CEO for $GE than Welch (FWI). We published a brief video about behavioral biases in assessing CEO effectiveness. Suggestions for other reading material in that video and attached transcript.

Why expansions die (Financial Times Alphaville). I think that I have access to Alphaville because I applied and was accepted as a member of the financial research community. If you can’t access this article, let me know and I’ll copy it off and send it to you. The article is a great look at the three factors that bring about economic contractions:

- Domestic imbalances

- Foreign shocks

- Ill-timed Fed tightening

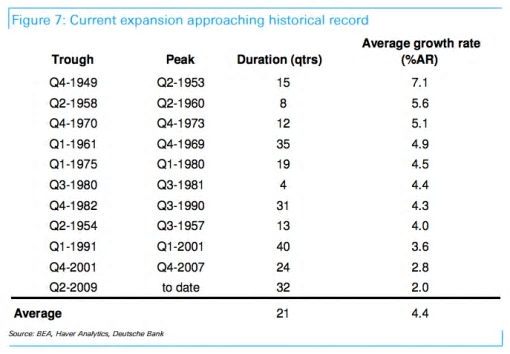

The article makes a good argument that domestic imbalances are fairly minor (“imbalance” means overinvestment like when we overinvested in property in the mid-aughts or in dot.com firms in the late-90s), but that the chance for the last two conditions were fairly high. A telling table listed periods of expansion by duration and strength. By this measure, the present expansion is very long and very weak, and the author points out that recoveries have been getting progressively weaker since the 1970s.

Nature’s Critical Warning System (Quanta Magazine). What do bass and minnows have to do with economics systems? Research into complexity studies regarding why seemingly stable systems can exhibit such sudden variability may be as apropos to financial markets as it is to populations of bass and minnows. Ecologists working at a small lake in northern Wisconsin found that a long, stable periods favoring one ecological regime or the other could be disrupted at key periods of “critical slowing.” Minnows thrive when algae levels are high but bass do not; as long as algae levels are high, the lake exists in a “minnow regime.” Bass prey on minnows so if algae levels are reduced enough for bass to thrive, they eat all the minnows and the lake enters a “bass regime.” Even within these stable regimes, there are times of greater likelihoods that the regime will shift. Critical slowing refers to the time it takes a system responds to a small disturbance. During these times, a random change in circumstances or inputs can swing the system from stability to breakdown and eventually can swing it into the opposite stable regime. I read this article because of one of the comments to the FT article above. Note that average growth rates of the economy in response to a downturn have been consistently slowing throughout the entire post-War period. Could the economy be at a critical slowing turning point?

Fed raises rates for second time in 2017 (Financial Times). Common wisdom says that Fed tightening is not good for stocks, but some research we have done suggests that tightening has no significant impact to stock returns on a two-year holding period. Recently, I’ve read several papers that contend it is not individual rate rises that are harmful to stocks, but a succession of them. We’ll try to dig through those data to test that contention as well.