From burritos to locomotives and a few things in between, this week gifted us with some interesting news stories. I won’t comment on the latest iteration of the GOP Healthcare plan, on the Presidential tweet banning transgendered people from serving in the military, or even what looks like the beginnings of a really great no-holds-barred mixed martial arts showdown between certain members of President Trump’s inner circle – I’ll leave those to the gentle reader to either pursue or ignore privately.

Here is a curated list of important stories outside the main headlines that caught our attention this week.

EU ready to retaliate against US sanctions on Russia (Financial Times). One group that should be very happy about the Trump presidency is the community of academic game theorists. The saga of the Republican healthcare bill will be a game theory case study for years to come, but perhaps that is not even the most juicy example. Last week, Congress reached a deal regarding sanctions (NY Times coverage) that seeks to punish the Russians for interfering in the 2016 presidential election. Sunday, the Trump administration signaled that it would sign the bill into law (NY Times coverage). From a game theoretical perspective, President Trump does not have a very good choice about whether to sign the sanctions into law. Under current investigation for his campaign’s alleged collusion with Russia’s security services and criticized at every turn for his softness on Putin, vetoing the bill would add fuel to the fire of the accusations. However, signing the bill does a few things: 1) limits the power of the executive office (see the second NYTimes article above), and 2) angers large multi-national oil interests. European oil companies, which do a brisk business in Russia and are dependent on Russian gas reserves, have complained to the EU, which is in turn, threatening to respond in some way against the US. For me, who had long expected the US to enter a trade war during the Trump administration, never expected a trade war to be initiated against the US by the EU, and especially not for action taken against Russia, which is no friend of the EU. What a tangled web we weave…

The Chipotle Corporate Sabotage Theory Returns (Bloomberg). Chipotle CMG has had a tough run of it for a few years, falling from over $700 per share to around $500 per share at the end of 2015 on news of its liability in a food-borne illness outbreak. Another outbreak recently sent the share price down to the $340 level – as low as it has been since April 2013. Among all this, famous investors have lined up on both the long and the short side (see the Framework article about what it means to “short” a stock) and big money is being placed on either side of the bet. Could it be that the most recent outbreak of norovirus was caused by an agent of industrial espionage hoping to profit from a fall in the stock price? This article quotes a food industry consultant whose team of statisticians and food safety experts that thinks the number of people affected by the recent outbreak linked to Chipotle is suspiciously high. Stranger things have happened, but if a short-seller is discovered as being the source of a food poisoning scheme, let’s hope that s/he gets more time behind bars than Raj Rajanatnam, who is serving 11 years in a federal prison after being convicted of insider trading.

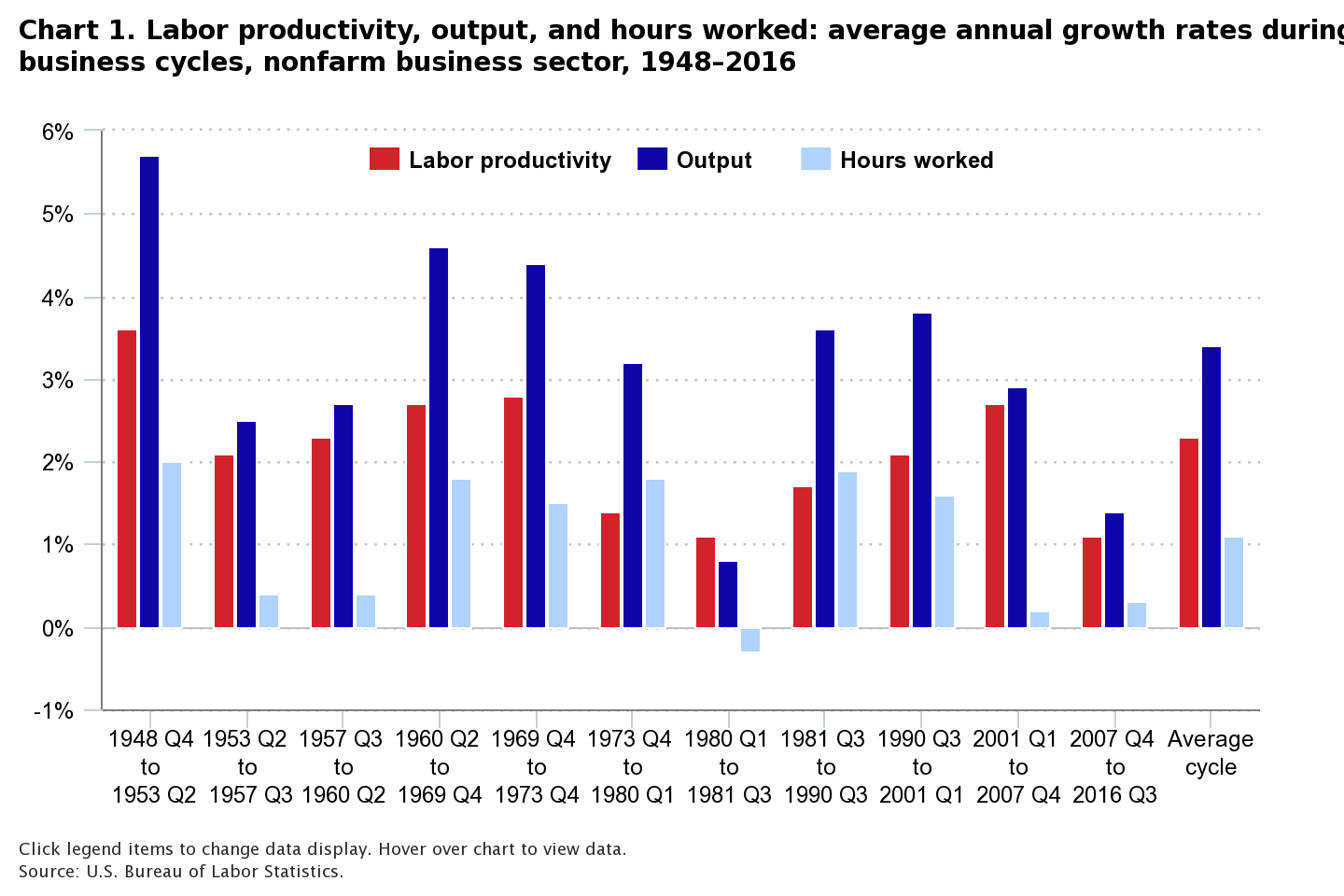

Maybe We’ve Been Thinking About the Productivity Slump All Wrong (NY Times). The wealth produced by a nation can be broken down into two parts – a part that varies mainly on population growth and a part that is tied to increases in productivity of that population. Productivity has fallen off since the Financial Crisis and is now hovering around the lows of the early 1980s. Economists have attempted to understand this drop-off in productivity and have tied it to “natural cycles of innovation” and a lot of other things that have always struck me as hand-waving. This article highlights new academic research that forwards a plausible, interesting explanation: our productivity is flagging because it need not be better. In short, wage growth has been slow for a long time and, coupled with household deleveraging after the financial crisis, people have been hesitant to spend. This depressed demand for products and services means that companies are hesitant to spend large outlays to develop and install time- and labor-saving innovations. There is slack in the labor market, so there is no particular need to be more efficient, and efficiency is at the heart of productivity. I have not read the paper – published by a think tank – but the article has a good summary of the argument made.

GE to Cut 575 Jobs at Century-Old Locomotive Plant (Bloomberg). In our analysis of GE’s recent earnings announcement (available to members here), we suggested the possibility that John Flannery might sell of GE Transportation, the division that mainly designs, manufactures, and sells railroad locomotives. This article claims that activist Trian Fund Management has pushed for cost-cutting and that this division – moribund in the US, but experiencing robust order flow from overseas – was the first to feel the bite. The jobs will not be lost per se, but rather transferred to a cheaper non-union plant operating in Texas. The report claims that no jobs will be shipped overseas. If we are right about an eventual disposition of GE Transportation, this move might help the firm to fetch a better price, by showing that profit margins are on the increase. This is just one anecdote, but a collection of anecdotes sometimes forms a trend…

Fed ready to unwind crisis-era stimulus from next meeting (Financial Times). This week’s meeting of the Federal Open Market Committee – the voting governors of the Federal Reserve Bank – did not result in a rate rise, but did spell out the plan to start to reverse the enormous bond purchase program termed Quantitative Easing that the Fed began as a result of the 2008-2009 financial crisis. When I attended the Grant’s Interest Rate Observer Conference in March of this year (Framework members can download my conference notes here), many of the speakers expressed their opinions that reversing QE was going to be more painful and unpredictable than many on FOMC were predicting. According to this article, the Fed will likely start on this process at its next meeting, in two months’ time. A hedge fund friend with whom I spoke the other day made a good case for the idea that the liquidity sloshing around the market as a result of QE policies was at least partially responsible for the market’s strong performance this year. If the initiation of the QE unwind coincides with what looks like the Trump administration’s difficulty in convincing lawmakers of its tax reforms and / or infrastructure plans, it might be a good time to fasten your investing seatbelts.