Two out of two experts agree: Most analysts grossly overestimate free cash flow. They do so at their own peril, and if you believe them, you are in the self-same peril.

This afternoon, I sat down to listen to Barry Ritholtz?s radio interview of Kynikos Associates? founder Jim Chanos and was happy to hear Chanos saying exactly the same thing regarding free cash flows that I explain in The Framework Investing.

Namely, that calculating free cash flows without consideration of the cash (or equity) spent on acquiring competitors or adjacent businesses is a boneheaded thing to do that ends up giving an investor an unrealistically rosy view of a company?s ability to generate wealth for its owners.

Most investors calculate free cash flow (FCF) as Operating Cash Flows (OCF) minus cash spent on Expenditures for Property, Plant and Equipment (PP&E). Or, in equation form:

But what is the difference between a company spending $100 to build a new factory and equip it with machines (the classic example of PP&E Expense) and it buying a competitor with a factory and machines for $100?

The economics between the two situations are identical, so it follows that an acquisition should be treated as a deduction from free cash flow!

But what about the case when a company issues stock to acquire a company? Cash is not being spent, so surely stock-based acquisitions should not be considered as deductions from FCF.

The use of common stock as a form of currency is something I also discuss in The Framework Investing. The Cliff?s Note version is that there is no such thing as a free lunch.

Companies do not issue shares without having a plan to buy them back. More shares outstanding makes it more likely for earnings per share (EPS) to be depressed, and a depressed EPS is the best way for a CEO to lose his or her job. How does the company buy shares back? With cash flow from the business that would have otherwise flowed through to the owners. In other words, as a deduction from FCF!

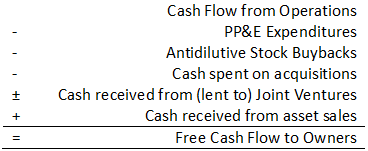

What is a better way of calculating free cash flow? My favored calculation and the one I detail in my book (and the web appendices to the book) is what I call Free Cash Flow to Owners (FCFO). Here is how to calculate this measure:

Because there are so many ?lumpy? numbers (i.e., quantities that we don?t expect to have a constant run rate from one year to the next), FCFO can be pretty lumpy from year to year. This is why it is a good idea to analyze a firm for a longer period of time to get a sense for FCFO margins and growth rates over an entire cycle.

Analyzing firms is not a precise science. Any analysis you see that has numbers taken out to two significant digits (e.g., 1.83%) is a ridiculous exercise in false precision. But by looking at FCFO over a cycle and at its components, an intelligent investor can get a good sense of roughly how much cash he or she can expect to lay claim to as an owner of the firm.