This morning, Oracle (ORCL) announced that it had finalized an agreement to buy Cloud-based Enterprise Resource Management (ERM) provider NetSuite (N) for around $9 billion.

This transaction makes sense from a strategic business standpoint – Oracle has gained access to NetSuite’s small and medium-sized business clients and can now pull them into Ellison’s enormously profitable software update engine. It was a good move for Ellison himself, since he and his family own a significant proportion of NetSuite’s stock (Ellison seems to always figure out a way to do okay by himself…).

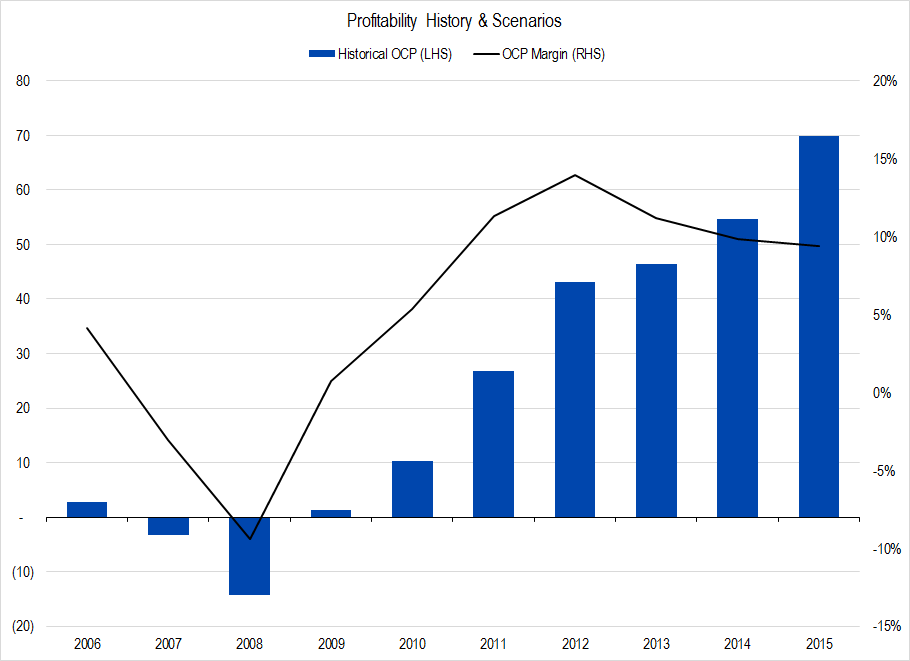

Reading web analyses of NetSuite, one common complaint is that the firm consistently fails to generate an operating profit. Looking at the firm’s financials this morning after the announcement, I found that, in fact, on IOI’s preferred measure of profitability – Owners’ Cash Profits (OCP) – NetSuite has been profitable since 2009 – two years after its IPO.

Figure 1. Source: Company Statements, IOI Analysis

NetSuite’s 10% OCP margin is considerably lower than Oracle’s 35%, it’s true, but it is indeed profitable. And as Oracle plugs NetSuite into its marketing organization, I’m confident that its profitability will do nothing but improve.