Back in March, we published a speculative recommendation on National Oilwell Varco ($NOV) as well as several articles (here’s the Step-by-Step Valuation article I did for Forbes) and research reports on the company (available to IOI Members).

We found that because of National Oilwell Varco’s dependence on the offshore drilling business, a good deal of the company’s value hinged on oil price levels. This may seem like an obvious connection, but drilling new offshore rigs represents the most expensive oil production and is thus most economically sensitive to low oil prices; as such, NOV’s value is particularly closely tied to oil price levels and how long those levels persist.

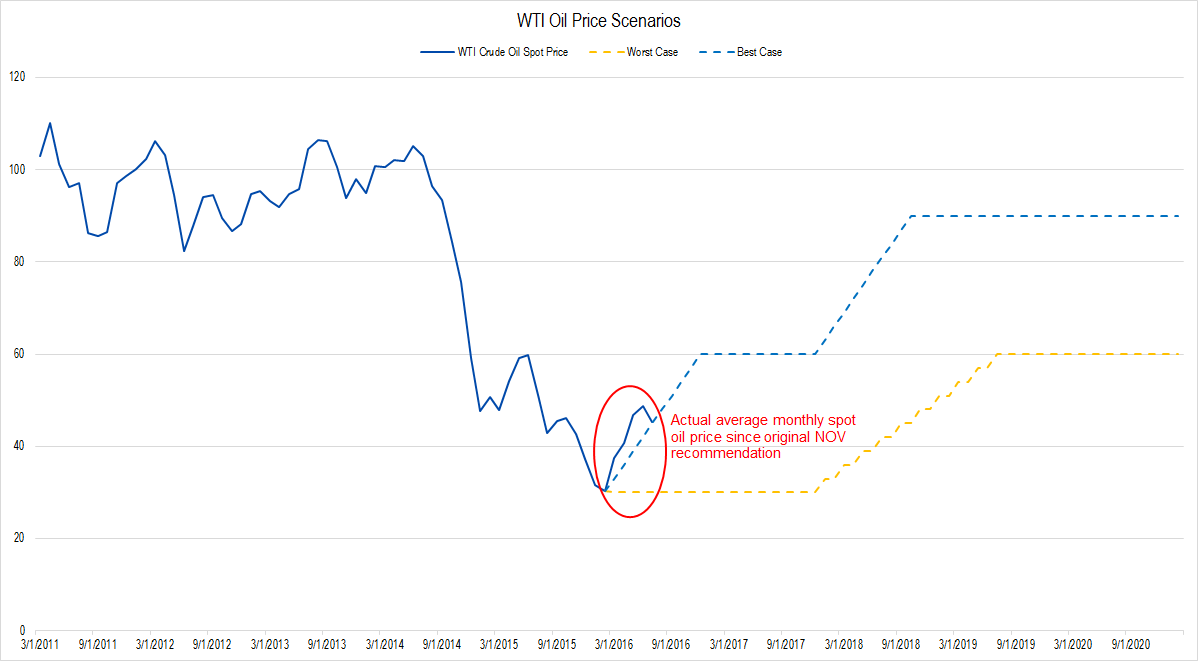

In true IOI fashion, we came up with best- and worst-case scenarios for oil prices and tied some portion of our revenue and profitability scenarios back to those them.

A few months have passed and we wanted to check up on how our best- and worst-case oil price assumptions were holding up against actual market prices for oil. Periodically going back to check valuation assumptions against actual results is a vitally important step in becoming a better, more intelligent investor because it allows us to understand how our investments are doing on the basis of value rather than the transient basis of market price.

Figure 1. Source: YCharts, IOI Analysis

Oil prices increased quickly from March’s lows, but have fallen back again more recently. This makes sense in terms of our understanding of onshore production capacity. When oil prices rise, onshore producers step in to pump out relatively inexpensive reserves; this increased supply, in turn, drives prices down as long as demand does not experience a simultaneous uptick (it hasn’t).

In terms of investing strategy, an intermediate oil price scenario is almost as bad as a worst-case one for NOV, because unless producers believe that oil prices are going to rise to $60+ / bbl and stay there for a while, they will likely not spend money to explore offshore and plan to drill new wells.