“Why do you hold [Insert FAANG or other popular stock name here] in your portfolio?”

When I ask new Framework Investing members that question, the most usual response is a collection of hazy impressions, anecdotes, and appeals to the dubious authority of “they” (e.g., “They said that the newest product would be a game-changer.”).

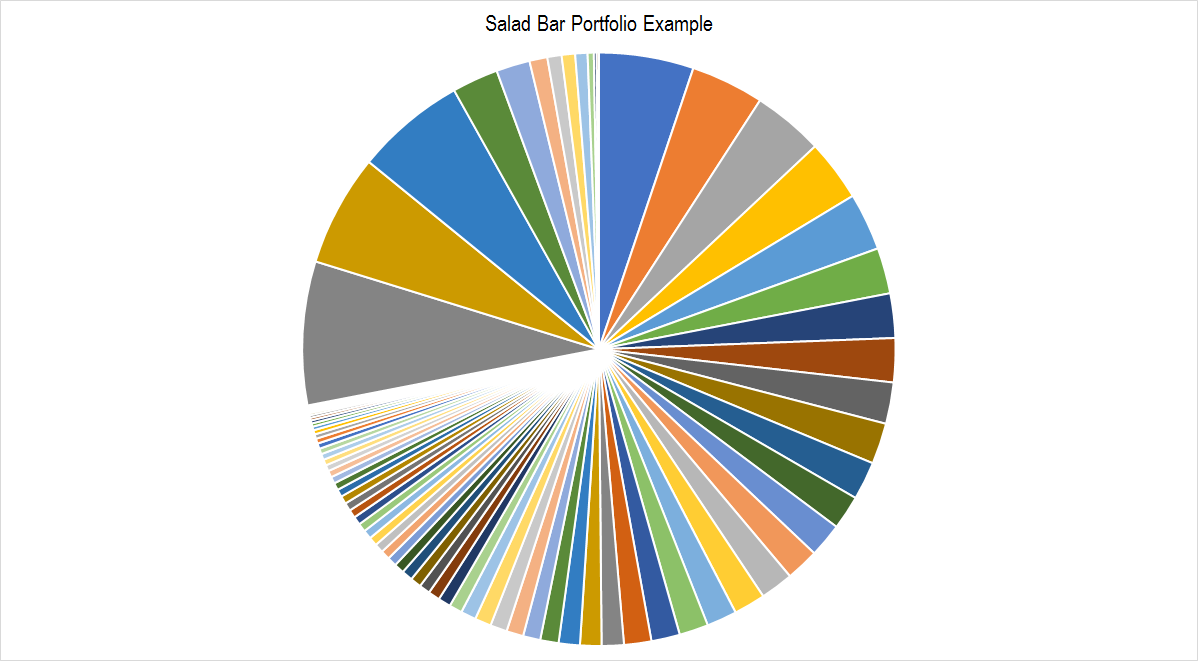

Portfolios are often a filled with odd-sized positions – many individual investors even run what amounts to their own mutual funds with dozens of small holdings, the sizing of each of the positions seemingly chosen at random.

An Example of a Salad Bar Portfolio

This haphazard approach to making investment decisions and structuring a portfolio is what I call “Salad Bar Investing.” A salad bar is a wonderful way to get a healthy meal as long as you are well educated in nutrition and disciplined about the choices you make. However, in investing, like in life, they can also be opportunities to pick up a lot of empty calories that don’t do you any good in the long run.

My job for the last eight years has been teaching people how not to wind up with the investing equivalent of a big plate of investing Jello, creamy potato salad, and chocolate pudding.

How to Avoid Empty Investment Calories

The first, best thing to do as an individual investor is to understand the nature of the game. A lot of professional intermediates such as newsletter writers, stock brokers, and analysts want to convince you that with their advice, you can beat the market.

They are lying.

All financial intermediaries are incentivized to help themselves first and foremost, and if some of their advice helps you, that makes it easier for them to help themselves in the future.

There has been study after study showing that it is phenomenally difficult for professional investors – highly-trained specialists with almost unlimited information resources – to build portfolios that consistently beat a market index over an extended period. This has a great deal to do with incentive structures and time horizon differences – factors that can never be perfectly resolved.

Just because a pro cannot beat the market does not mean that an individual cannot beat it him or herself. It only means that an individual investor cannot beat the market using the methods professional investors are already using to lag it.

If you want to do better than 98% of all professional investment managers, turn off the cable business channel, cancel your subscription to your investment newsletters, and dollar cost average into the cheapest broad-based market basket you can find in the form of a low-cost index mutual fund or ETF. This is the advice that Warren Buffett gave to his wife and it’s the advice I’m giving you now.

Picking through a salad bar of newsletter authors’ picks and sell-side analysts’ buy and sell recommendations is going to leave you with a portfolio that is skewed and biased. This portfolio is 100% guaranteed to lag the market.

Successfully Managing an Active Portfolio

Some investors do want to take a more active role in their investment decisions and portfolio composition. An active individual investor can be more successful than a professional fund manager – and can beat an index – as long as they have “…a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework,” as Warren Buffett says.

We wrote a series of articles about sound investing frameworks (The Benefits of a Framework in Investing, Three Characteristics of a Good Investing Framework, The Elements of an Effective Real-World Investing Framework, Three Examples of an Investing Framework in Action), but we summarize a few key points below:

- Pay attention to costs and “efficiency.”

- Don’t buy a stock for which you are not able to estimate its long-term intrinsic value.

- Learn how to estimate the value of a company by focusing on the big picture.

Point One: Most of your investment assets should be allocated to the cheapest index fund you can find. No investor has to invest in a given stock – there are no “called strikes” in investing. In my opinion, the default allocation of an investor should be to the broad market index. For a typical active investor, that might mean 80% of their allocation to stocks is not an investment in individual names, but rather an investment in equities as an asset class. Index funds are inexpensive and, as we mentioned above, more ‘efficient’ (i.e., better performing for a given amount of risk) than actively-managed funds.

Point Two: Never to buy a stock for which you are not able to estimate a fair value range for the underlying company. Estimating a fair value range does not mean collecting a few anecdotes or hazy impressions about a company. Anecdotes are usually one-off observations (“Sales of the next iPhone will beat all prior records.”), are invariably short-term (“The company will make $0.13 this quarter, but the Street is only expecting $0.11 to $0.12), and are rarely related to the company’s success or failure to meet observable operational performance over time – the one thing that does alter a company’s value.

Point Three: Understand how to make a reasonable, testable estimate of the value of a company. There are only a few factors that drive the value of any company – revenue growth, profitability, and investment level and efficacy. Before you invest in an individual company, you should understand how that company’s operational strategies are positioned to affect each of those drivers and how a change in each will alter the companies value. While you are invested in the company, you have to be able to check your original assumptions and change course if they were not correct – either by adding to or reducing your position size. Every time you invest, you learn how to be a better investor, creating a virtuous circle that will serve you well over the long run.

The Transformation of a Salad Bar Portfolio

We recently started tidying up a salad bar portfolio with a view of creating a steady, sufficient, and safe income stream for a retired person. You can see how we are transforming a portfolio that originally held 86 different assets into one that is manageable, sensible, and well-performing by signing up for a Framework Investing membership.

This article originally appeared on Forbes.com