At the Spring 2015 IOI Boot Camp, Brent Farler, a corporate restructuring investment specialist and retired turn-around banker gave a presentation on?a process he had seen thousands of times–what happens both inside a company and in the market when a company is trying to sort out major problems.

He talked about some notable cases like Cisco, Autonomy, Hewlett-Packard, and Kodak, classifying these companies into different types of restructurings, such as “Unmet expectations” and “Poor Management.” He made the excellent point that different types of restructurings require different investment approaches, and suggested option investment strategies for different cases.

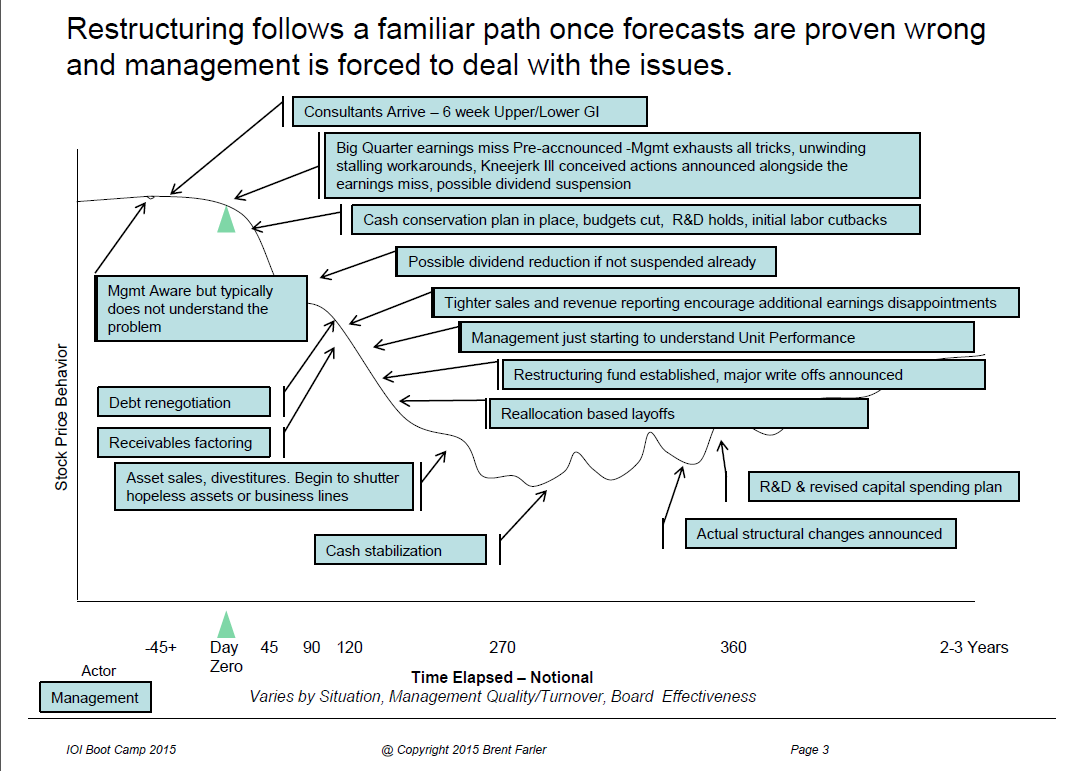

He also charted out what the market price of a stock stuck in the midst of a restructuring might look like, and approached the chart from various perspectives–management teams, and institutional and retail investors (an excerpt of the management perspective chart is shown above).

Restructurings represent a terrific opportunity for intelligent investors, and Brent’s framework for analyzing turn-arounds was a great education to me and the other Boot Camp participants.