[This article originally appeared on Forbes.com]

There has been a lot going on at and around General Electric (GE) lately. The firm announced it was selling off its asset management business (to State Street) and a day later, submitted a request to the Department of Treasury to have its designation as a Structurally Important Financial Institution (SIFI) removed. A few days ago, an influential sell-side analyst at the broker Sanford Bernstein, Steven Winoker, downgraded GE from Buy to Hold citing 1) it’s recent stock price rise and 2) its PE multiple. (For those of you who have taken an IOI training session, Winoker’s reasoning should strike you at once as amusing and fitting, coming as it does from a sell-side research analyst).

GE had published its 2015 annual report a few weeks ago, and since there was so much news flow around the company, we sat down to refresh our step-by-step valuation of the firm. (This article is an excerpt from a longer valuation report available on our website.)

Here is a graphic depiction of the results of our valuation analysis, which sees moderate (20%-40%) upside potential in the shares with limited downside valuation risk.

Figure 1. Source: CBOE, YCharts, IOI Analysis. The cone-shaped region represents the option market’s best idea for the future price of the stock. The geometric shapes to the right of the diagram represent IOI’s estimated valuation range.

For a review of our valuation methodology, please see the Forbes article entitled A Step-by-Step Valuation of Oracle, which includes a summary of how we analyze valuation drivers and growth before diving into the valuation of the software giant. For those who want to delve deeper, IOI offers in-depth valuation training courses as well.

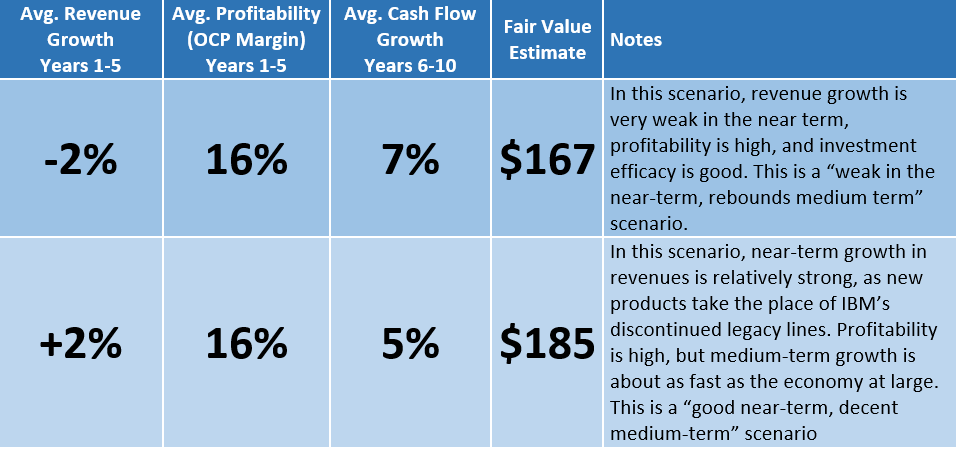

The best- and worst-case inputs that went into our analysis of GE and the related valuation scenarios are as follows:

(OCP margin is my preferred metric for assessing profitability, based on what I term Owners’ Cash Profits.)

While we are much less excited about GE as an investment candidate with the shares hovering around $31 / share than we were when they were scraping $25 / share, the divestment of large swathes of GE Capital Corp (GECC) does improve our visibility into the company and, in general, we like what we see.

GE was not always a financial giant. When Neutron Jack Welch took over as CEO in the 1970s, finance represented only a minuscule portion of GE’s revenues — which at that time was overwhelmingly generated by a wide range of industrial and consumer products. Welch’s realization that finance arms could be used for two very useful tasks — avoiding corporate income taxes and “managing” earnings — meant that over time, the strategic emphasis of GE shifted to GECC.

Welch’s unfortunate* successor, Jeff Immelt, continued with the emphasis on finance** until 2008-2009, when GECC’s financial engineering suddenly didn’t seem like so good of an idea. Immelt has been scrambling ever since to unwind as much of the finance business as possible.

We believe that the application to remove its SIFI status marks a milestone in its re-structuring process and doubt there is much left in the way of finance business divestment in the works for GE.

GE is still (in)famous for leaning forward as far as possible regarding tax management schemes and structures. Many of these structures result from sale-leaseback transactions that are managed through the remaining GECC businesses. Without these tax dodges, GE would be stuck paying a higher tax rate than it does at present. Needless to say, it’s unlikely that, barring a revolutionary rewrite of the U.S. tax code, GE will voluntarily divest itself of these valuable tax avoidance profit centers.

We believe that, similar to Ford, GECC also pulls some demand forward by offering financing for some of its products, but there is still enough divestment noise in the financial statements to make an accurate assessment of the extent of this effect difficult to judge. This issue is one that we will be watching in quarters to come. At present, we do not believe the firm is “buying its revenues” by lending money to its customers.

Many long-term (read “suffering”) holders of GE’s stock look back to the halcyon days of Neutron Jack Welch with great fondness, and look on Jeff Immelt as incompetent. In our opinion, these observers have it backwards. Welch is ultimately responsible for sowing the seeds of GE’s near destruction during the mortgage crisis with his tunnel-vision emphasis on the finance business. Immelt continued down his mentor’s path, but to his credit, also realized that the sword of leverage cuts both ways and had the brains to start divesting GE of that business post-Crisis. In our opinion, Immelt has done a credible job of re-structuring the firm and laying the foundations for its future success.

NOTES:

* Unfortunate because he took over from Welch on September 7, 2001 — days before 9/11 — not good timing for the CEO of a company that makes airplane engines.

** Like drug addiction, a predilection for earnings management tends to be an inter-generational problem.

To Learn More, Contact Us!